Overview of “Money: Master the Game”

“Money: Master the Game” by Tony Robbins offers a comprehensive guide to achieving financial freedom through practical steps and expert insights. The book provides a 7-step blueprint for managing finances, investing wisely, and building wealth, making it accessible to readers of all income levels. Robbins draws from interviews with financial luminaries like Warren Buffett and Ray Dalio, ensuring actionable advice for securing a lifetime income plan and overcoming financial myths.

Purpose and Structure of the Book

“Money: Master the Game” is designed to empower readers with actionable strategies for achieving financial freedom. Structured around a 7-step framework, the book simplifies complex financial concepts, making wealth-building accessible to everyone. It combines insights from over 50 financial experts with practical advice, ensuring readers can create a tailored plan for securing their financial future. The book’s clear, organized approach makes it a valuable resource for all income levels.

Significance of Financial Freedom

Financial freedom is the cornerstone of security, peace of mind, and the ability to live life on one’s own terms. It enables individuals to pursue passions, support loved ones, and leave a lasting legacy without debt or financial strain. Achieving this freedom allows for greater opportunities, reduced stress, and the confidence to face life’s uncertainties with resilience and clarity.

The 7 Simple Steps to Financial Freedom

“Money: Master the Game” outlines a 7-step roadmap to financial freedom, offering practical strategies to manage finances, invest wisely, and build lasting wealth for all readers.

Step 1: Take Control of Your Financial Decisions

Taking control of your financial decisions is the first step toward freedom. Robbins emphasizes understanding your spending habits, creating a budget, and setting clear financial goals. By making informed choices, you avoid emotional decisions and focus on long-term wealth-building strategies, empowering yourself to manage your money effectively and achieve financial stability.

Step 2: Set Up a Savings and Investing Plan

Creating a structured savings and investing plan is crucial for financial growth. Robbins advises automating savings, starting small, and increasing contributions over time. He advocates for low-cost index funds and diversification to minimize risk. By prioritizing consistent investing, readers can build wealth steadily, even with modest income, aligning with long-term financial goals and fostering financial independence.

Step 3: Destroy Myths About Saving and Investing

Step 3 challenges common misconceptions about finance, such as the belief that high returns require complexity. Robbins emphasizes that investing doesn’t need to be complicated or expensive. By focusing on low-cost index funds and consistent savings, readers can debunk myths and build a solid financial foundation. This step encourages a mindset shift, helping individuals overcome fear and misinformation to make informed decisions.

The Myth of High Returns

Tony Robbins challenges the belief that high returns require high risk or complexity. He argues that steady, long-term investments in low-cost index funds can deliver significant returns without excessive risk. Robbins emphasizes that financial success is more about discipline and patience than chasing high-risk, high-reward opportunities, making wealth-building accessible to everyone.

The Myth of Complexity

Tony Robbins debunks the myth that investing is inherently complex. He argues that financial freedom doesn’t require being a market expert or mastering intricate strategies. By simplifying investing—such as using low-cost index funds—Robbins shows how anyone can achieve financial success without needing advanced knowledge, making wealth-building accessible to all, regardless of background or experience.

Step 4: Set Up a Lifetime Income Plan

Creating a lifetime income plan is crucial for long-term financial security. Tony Robbins emphasizes the importance of generating consistent income that outpaces inflation; By leveraging strategies like annuities, dividend-paying stocks, and other income-generating assets, individuals can ensure a steady income stream. This step focuses on building a sustainable financial framework that provides peace of mind and supports retirement goals effectively.

Expert Insights and Contributions

Tony Robbins collaborates with top financial minds like Warren Buffett, Ray Dalio, and John Bogle, offering expert strategies for wealth creation and investment. Their insights provide practical lessons for investors of all levels.

Interviews with Leading Financial Experts

Tony Robbins interviews over 50 financial luminaries, including Warren Buffett, Ray Dalio, and John Bogle, to provide readers with proven investment strategies and wealth-building insights. These experts share their experiences and tips, offering a diverse perspective on achieving financial freedom. Their contributions enrich the book, making it a valuable resource for both novice and experienced investors.

Warren Buffett

Warren Buffett, a legendary investor, shares his timeless wisdom in the book. He emphasizes value investing, long-term strategies, and disciplined decision-making. Buffett’s insights on wealth creation and his “circle of competence” concept are highlighted, offering readers practical advice on building lasting financial success. His contributions provide a foundation for understanding smart investing and achieving financial freedom.

Ray Dalio

Ray Dalio, founder of Bridgewater Associates, contributes valuable insights in the book. He emphasizes the importance of understanding economic principles and advocating for radical transparency. Dalio highlights how Robbins simplifies complex investing strategies, making them accessible to all. His endorsement underscores the book’s practicality in helping readers achieve financial freedom through disciplined and informed decision-making.

John Bogle

John Bogle, founder of The Vanguard Group, praises the book for enlightening readers on mastering money. He highlights Robbins’ ability to simplify complex investing strategies, making them accessible to everyone. Bogle emphasizes the book’s focus on index funds and financial freedom, ensuring readers gain practical wisdom to secure their financial futures through disciplined and informed decisions.

Practical Lessons for Investors

Tony Robbins provides actionable strategies for investors, emphasizing diversification, index funds, and increasing savings. He encourages readers to adopt a disciplined approach to wealth-building, focusing on long-term financial freedom. Robbins’ insights help investors make informed decisions, avoid common pitfalls, and create sustainable income plans, ensuring a secure financial future through proven, practical methods tailored for all income levels and expertise.

Key Themes and Concepts

The book explores the psychology of wealth, diversification strategies, and the importance of increasing savings rates to achieve financial freedom and security.

The Psychology of Wealth

Tony Robbins delves into the mental barriers that prevent people from achieving financial success, emphasizing the importance of mindset, beliefs, and emotional mastery. He explores how fear, greed, and limiting beliefs can sabotage wealth-building efforts, while a growth mindset and disciplined habits foster financial freedom. Robbins highlights the psychological strategies to overcome these obstacles, aligning readers’ behaviors with their financial goals for long-term success.

Diversification and Index Funds

Tony Robbins emphasizes the importance of diversification and index funds to minimize risk and maximize returns. By spreading investments across asset classes, investors avoid concentration risk. Low-cost index funds, recommended by experts like John Bogle and Ray Dalio, track market performance without high fees, offering a stable path to financial growth and stability.

The Importance of Increasing Savings

Tony Robbins underscores the importance of increasing savings as a cornerstone of financial freedom. He advocates automating savings, leveraging employer matches, and avoiding lifestyle inflation. By consistently boosting savings rates, individuals can reduce debt, build wealth, and secure their financial future. This disciplined approach ensures long-term stability and growth, aligning with Robbins’ emphasis on actionable strategies for achieving financial independence.

Book Reception and Reviews

“Money: Master the Game” has received widespread acclaim, boasting a 4.6-star rating with over 14,241 reviews. Readers praise its clarity, actionable advice, and inspiration, though some find it lengthy.

Customer Feedback and Ratings

“Money: Master the Game” holds a 4.6-star rating with over 14,241 reviews. Readers praise its clarity, actionable advice, and motivational tone, with 1,109 positive comments on information quality; However, some critics note the book’s length and repetition, with 55 negative reviews on this aspect. Overall, it’s highly recommended for both beginners and experienced investors seeking financial freedom.

Positive Reviews

Readers praise “Money: Master the Game” for its clarity and actionable advice. Many highlight how the book helped them take control of their finances and set up investment plans. The motivational tone and expert insights from figures like Warren Buffett and Ray Dalio are frequently commended. With 1,109 positive comments on information quality and 1,053 on readability, it’s a top choice for transforming financial knowledge into practical success.

Negative Reviews

Some critics find the book overly lengthy and repetitive. A few readers mention that the content, while valuable, could be more concise. Additionally, 87 users noted the book’s length as a downside, and 55 found certain sections repetitive. Despite its strengths, some readers feel it could be more focused to enhance readability and retain reader engagement more effectively.

Awards and Recognitions

“Money: Master the Game” has received widespread acclaim and is part of the Tony Robbins Financial Freedom Series. While not explicitly awarded a Pulitzer Prize, it has been praised by Forbes as deserving of such recognition. The book’s impact and popularity have solidified its place as a leading resource in personal finance, earning it a reputation as a must-read for financial freedom seekers;

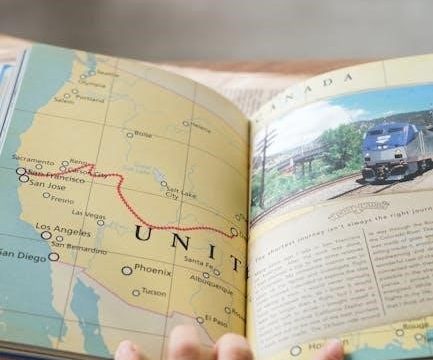

How to Read “Money: Master the Game”

“Money: Master the Game” can be downloaded as a PDF and read using apps like Adobe Acrobat, Apple Books, or Google Play Books for a seamless experience across devices.

Downloading the PDF

The PDF version of “Money: Master the Game” can be easily downloaded and accessed using popular PDF readers like Adobe Acrobat, Apple Books, or Google Play Books. This format allows for offline reading, making it convenient to access the book anywhere, anytime. The PDF ensures a seamless reading experience across devices, whether on a PC, tablet, or smartphone.

Compatible Readers

The PDF version of “Money: Master the Game” is compatible with popular readers like Adobe Acrobat, Apple Books, and Google Play Books. These apps support seamless reading on Android and iOS devices, ensuring a consistent experience across platforms. Compatibility extends to PCs and tablets, making the book accessible anytime, anywhere, with a reliable reading experience guaranteed.

Offline Reading Options

The PDF version of “Money: Master the Game” allows for offline reading, enabling access to the book anytime without internet. Compatible apps like Adobe Acrobat, Apple Books, and Google Play Books support offline access, ensuring uninterrupted reading. This feature is ideal for commutes, travel, or areas with limited connectivity, making financial freedom insights always reachable.